By Sne Dlamini, Head of Institutional Business at Old Mutual Investment Group

The Broad-Based Black Economic Empowerment (B-BBEE) Act, along with the Codes of Good Practice, have contributed immensely to promoting and empowering women in South Africa, however, there is still a great deal of work to be done. Women are still being sidelined in boardrooms and not considered for key leadership roles, especially in asset management.

However, the concept of gender-lens investing is starting to gain traction and could be key in guiding “captains of industry” to deliver on the gender agenda commitments.

Gender-lens investing involves the deliberate allocation of capital to companies that actively promote women’s empowerment, recognising that such investments can not only generate competitive financial returns but also contribute to the creation of a more equitable and inclusive society.

To assess how gender-lens investing contributes to advancing women, we can identify the following critical impacts:

- Investing in women-owned or women-led enterprises: This empowers women economically, fosters job creation and economic growth.

- Promoting workplace equity: Gender-lens investing encourages investment in companies that demonstrate a commitment to gender equity in their staffing, management, boardroom representation, and supply chains. This can lead to more inclusive workplaces, equal opportunities, and the breaking down of barriers to women’s advancement.

- Investing in gender-positive products and services: It targets businesses that develop products or services specifically designed to improve the lives of women and girls, such as in healthcare, education, safety, and financial inclusion.

- Influencing corporate behaviour: By considering gender-based factors in investment decisions, gender lens investing sends a strong signal to companies that gender equality is not only a social imperative but also a crucial aspect of good business practice.

- Driving financial performance: Companies with diverse management teams and a focus on gender equality often exhibit stronger financial performance.

- Addressing systemic inequalities: By focusing on various aspects of gender inequality, including access to finance, leadership opportunities, and fair treatment in the workplace, gender lens investing contributes to dismantling systemic barriers that hinder women’s economic empowerment and overall progress.

Addressing systemic inequalities

Within the South African financial services landscape, the principles of gender-lens investing hold particular significance. Given the nation’s complex history and the ongoing imperative to address systemic inequalities, integrating a gender perspective into investment strategies presents a compelling opportunity to foster meaningful social and economic transformation.

Several global initiatives are pushing gender lens investing forward, such as the 2X Challenge, spearheaded by Development Finance Institutions and International Financial Institutions, which has been instrumental in encouraging private market investors to adopt this approach in Africa and other emerging markets. From 2021 to 2022, the 2X Challenge exceeded its target, driving gender-lens investments to the value of $16.3 billion and benefiting 473 businesses across various regions.

The Global Impact Investing Network also actively supports investors in implementing gender lens investing by providing resources and up-to-date information. Their work aims to close the “gender gap,” which refers to the difference between women and men in social, political, intellectual, cultural, or economic attainments.

While the adoption of gender-lens investing is demonstrably on the rise both internationally and within South Africa, it is important to also acknowledge that it has yet to become a mainstream practice. A practice one can say is desperately needed to add to the many initiatives that aim to address scars dating back centuries.

But we’ve had the Act and other legislation push transformation…

Yes. We have had legislation offer incentives for gender representation, but true transformation lies in reshaping the very fabric of workplace culture and dismantling the societal constraints that uniquely and unfairly burden women. Achieving this goal requires the implementation of fit-for-purpose policies that challenge cultural norms, redefine gender roles and offer support for women’s aspirations beyond the boardroom. We must have a holistic approach, or we will still be in this same position a few decades from now.

Analysing the JSE Top 40 companies, the 2024 Just Share report on Women in Leadership revealed that while women hold 36% of board positions, their representation in executive management roles is significantly lower, at just 23%. A modest increase in female board representation compared to previous years, but a concerning decline in the proportion of women in top executive positions responsible for the day-to-day operations and strategic direction of these major companies.

Zooming into the asset management industry, the underrepresentation of women becomes even more pronounced in specific functional areas critical to the core business of asset management. Within portfolio management, a key area of investment decision-making, women account for a mere 17.2% of professionals in South Africa, according to the 2023 EPPF Diversity in Asset Management research.

Most women in the asset management industry occupy analyst roles, as shown in the graph below and whether by choice or by design, the reality is that the systemic barriers that hinder women’s advancement do exist in our industry.

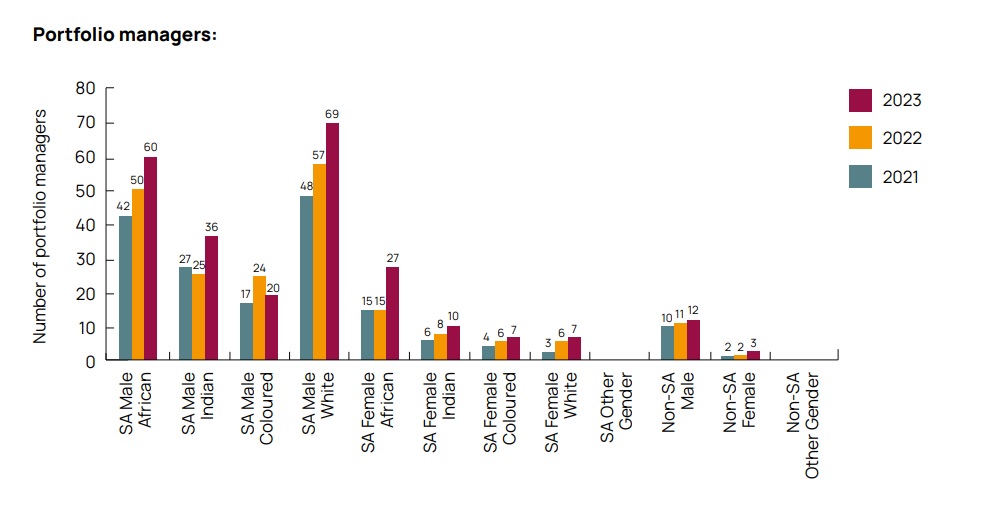

The graph below shows the split in the portfolio management level between men and women across races.

Source: 27Four BEE.conomics 2023 Annual Transformation Survey

The discrepancy between the percentage of women in South Africa’s economically active population (46%) and their representation in leadership positions across key roles in all sectors indicates a substantial untapped talent pool.

The time has come for asset owners and stakeholders to lead the way in granularly probing the gender issues in South Africa. We all have a role to play in changing this status.

Old Mutual Investment Group is the leading large asset manager on diversity, equity and inclusion (DEI) in South Africa*. Our commitment to DEI is evident both internally, through strong female representation across all levels (32% of the company is women-owned, with 50% board representation and 31% of investment professionals being women), and externally through Article 8 funds like the Old Mutual Global ESG Equity Portfolio and the Old Mutual African Frontiers Fund. These funds strategically employ a gender lens, prioritising investments in companies with significant women leadership at the board level, thereby aiming to foster not only financial returns but also broader community upliftment and a more equitable future. The journey ahead requires conviction and intent, but we stand firm in charting the path for gender equality in our industry.

*27Four DEInvest Survey 2024