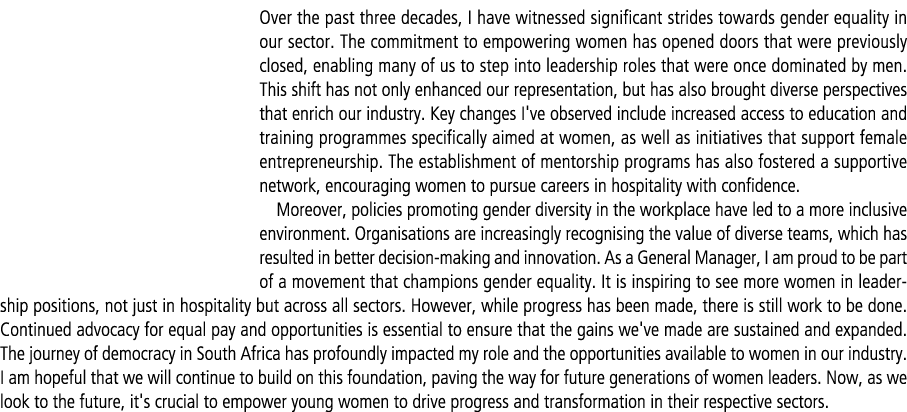

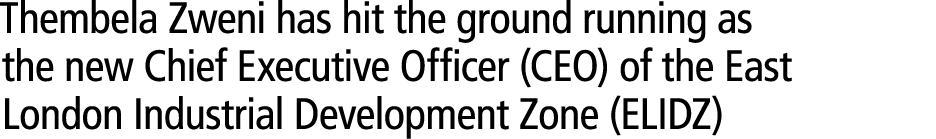

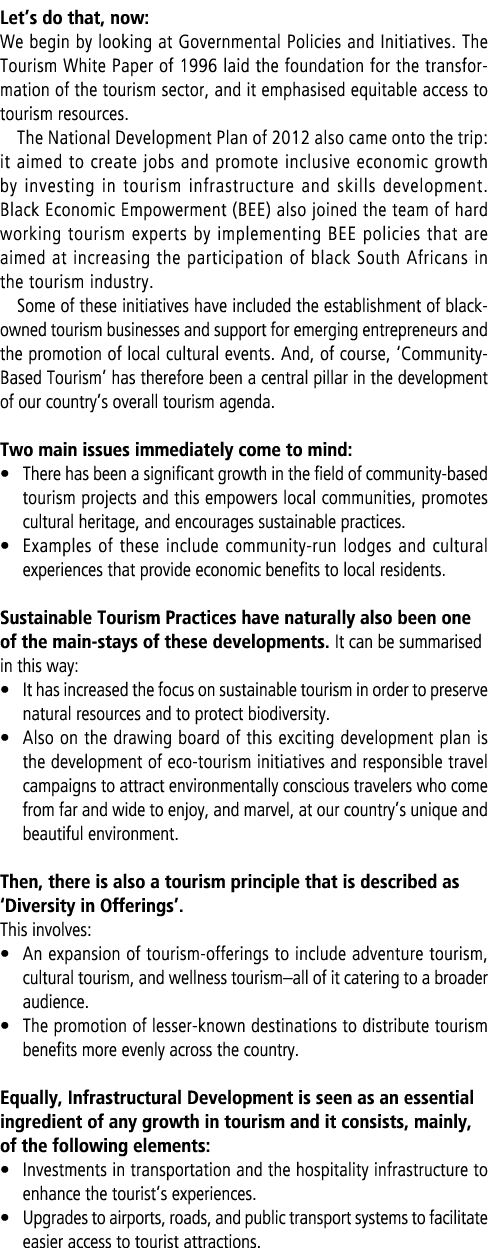

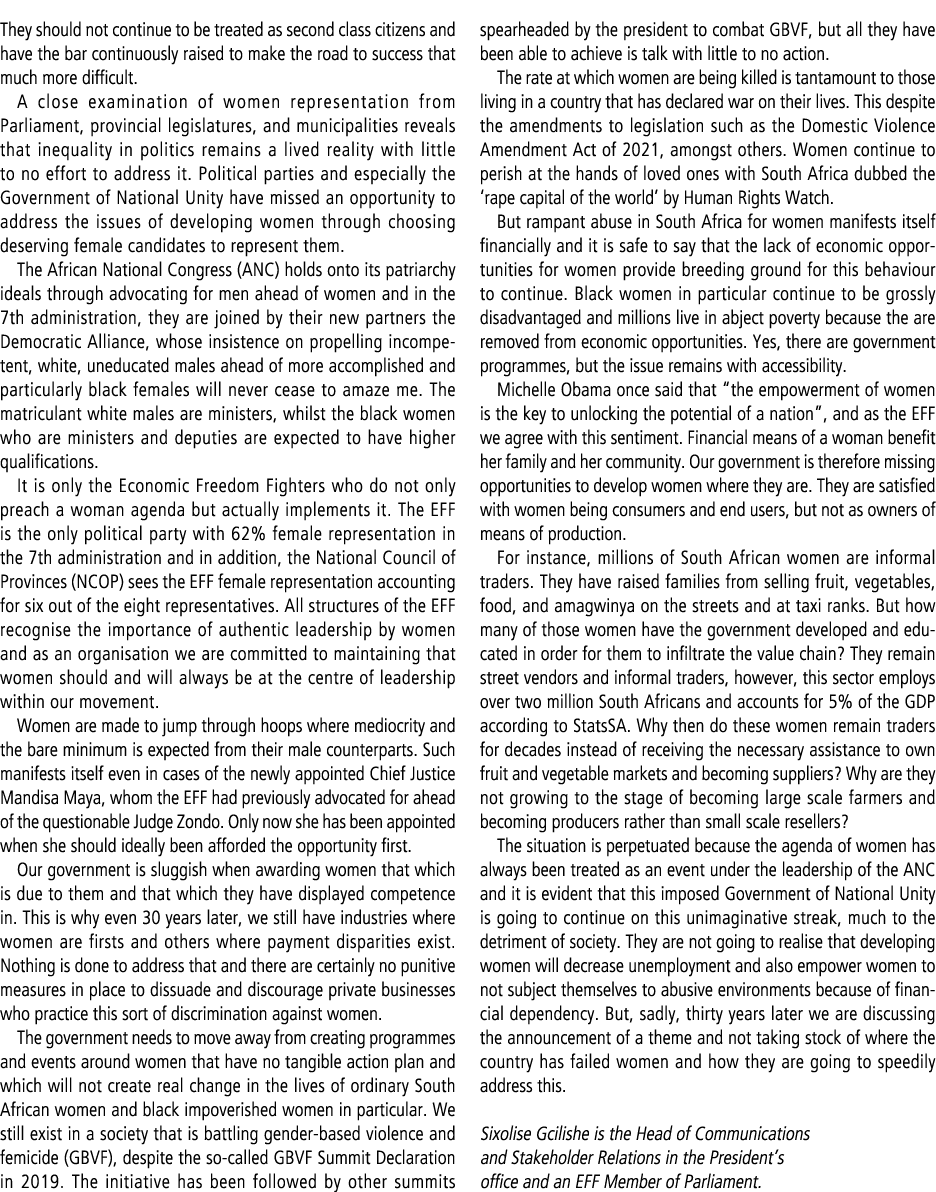

Zamani Letjane: a trailblazer

Akani Group Chairman Zamani Letjane can be described as a serial entrepreneur who has been making waves in sectors traditionally dominated by white males. Ido Lekota caught up with the businessman for a chat...

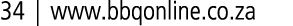

I am a serious challenger of the notion that black people are not capable of operating in specialised fields such as the financial sector. For example, many black businesses have been taken out of the race in the financial sector. I am the one man standing running the biggest black-owned Retirement Fund Administrator in the country.”

Under his holding company Akani Group, Letjane runs several other ventures, including Akani Retirement Fund Administrators, Akani Properties, Akani Energy, Munghana Travel and Tourism, and Neighbour Funeral Scheme–to mention just a few. Through these entities he is said to have created no less than 5 000 jobs.

Currently as Akani Group Chairman, Letjane believes that throughout his eventful career path he has planted a seed among many aspiring young entrepreneurs who are now ready to grab the torch and continue with the eternal marathon of driving this country’s economic transformation–especially in critical sectors such as the financial sector.

“I have trained many upcoming entrepreneurs who are ready to continue where I left off when I was still directly involved in the building of Akani Properties and Akani Retirement Fund Administrators. As you can see, these companies have risen to go pound for pound with established brands in the sectors they operate. I do believe that these ‘greenshoots’ will take the torch and join the marathon I have been running all these years as a black business in sectors that are historically owned and run by white males. The fact that these companies are now where they are is a clear sign that, despite attempts to undermine efforts by those who look and think like me, economic transformation will happen in this country.”

Letjane’s career started when he joined a private company as a Human Resources Practitioner in 1980.

He then joined the Human Resources Department of the Local Authority where he remained for 10 years. As a professional, Letjane has also played a role in both the private sector, where he made a contribution to the transformation of whatever sector participated in.

Before 1994, the world of pension fund administration in South Africa was essentially a closed shop between employers who established the funds, appointed the trustees, and attended to their administration, and the actuaries who advised them. This led to a situation where black members of the fund were, by law, excluded from become board members of pension funds.

Post-1994, Letjane was part of the Pension Funds Advisory Committee which advised the Minister of Finance on the structure and administration of the pension funds in the country. It is through this panel’s work that the Pension Fund Act was eventually amended to restructure the management boards of functions ensuring that all employees who were beneficiaries of the fund (including black members) were involved in its administration.

In his career, Letjane has also served in the boards of various other bodies, including:

- • South African Board of Personnel Practitioners: A body that monitors and audit companies and institutions in relation to their Human Resources practices covering various areas such as strategy, risk and compliance, employee relations, organisational development etc.

- • Institute of Municipal Personnel Practitioners: A body committed to empowering its members to deliver excellent service to the public through professional human resources management and high standards of integrity and commitment to public service. This also entails addressing the pressing challenges faced by municipalities and exploring innovative solution to enhance their performance.

- • Institute of Retirement Funds SA: A body focusing on the development of best practices and standards in the retirement industry–thereby ensuring socio-economic contribution, growth, and sustainability in South Africa and beyond.

Letjane was previously a Trustee of the Local Government Pension Fund, which owned several shopping centres around the country in its property portfolio. One of his duties was identifying sites where retail shopping centres could be constructed. He served in that portfolio for 17 years buying malls around the country.

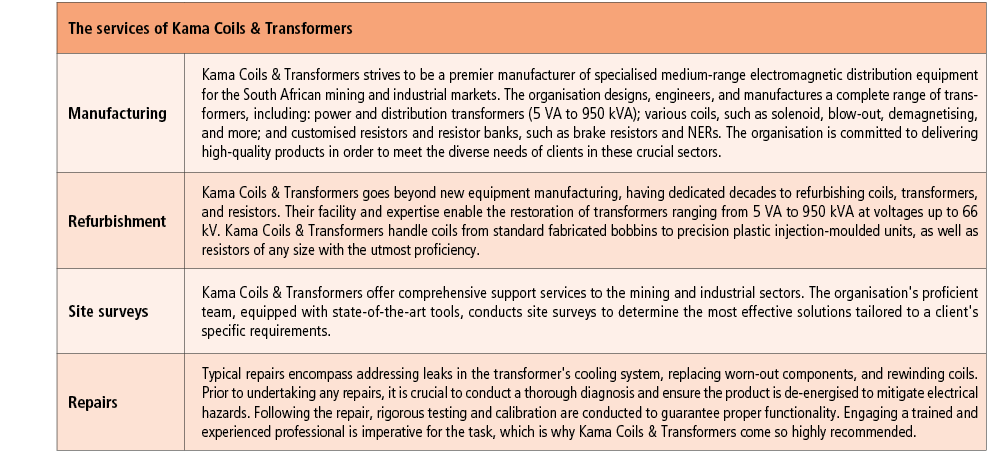

Akani Retirement Fund Administrators (Akani RFA)

After obtaining his retirement fund administration licence in 1999, he started Akani Retirement Fund Administrators in 2001. The company is currently the biggest 100% black owned, managed, and controlled retirement fund administrator in South Africa.

Akani RFA was appointed to administer the Municipal Employees Pension Fund (MEPF) in 2003, maintaining and growing the fund from R1.4 billion to over R26 billion in assets since then. As the MEPF administrator, Akani RFA’s responsibilities include:

- • Assist in formulating an investment strategy based on the Financial Advisory and Intermediary Services Act 37 of 2002 and international best practices.

- • Drafting of the Investment Strategy.

- • Assist in Assets Allocations.

- • Assist in Manager Selection.

- • Monitor Performance by Assets Managers.

Arrange for investments presentations by appointed investments managers. The Municipal Employees Pension Fund is a defined benefits and defined contribution fund which provides members and their dependants with reasonable and competitive retirement, resignation, and risk benefits (death-in-service and disability benefits). The fund was established in 1970 with the aim to service the retirement needs of the previously disadvantaged employees within local government.

Akani Properties

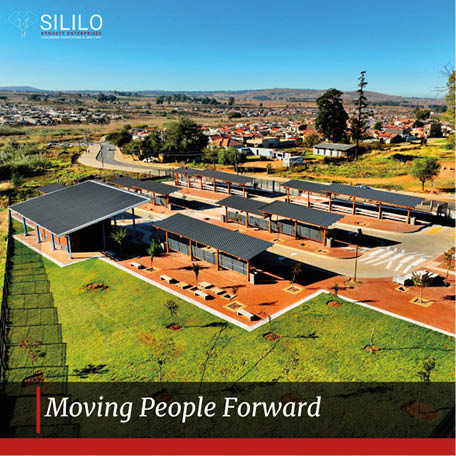

In 2005, Letjane started Akani Properties, a 100% black-owned and managed property development, investment, and management company with north of R3 billion total assets under its management.

Akani Properties manages a growing portfolio comprising more than 50 properties in retail, office, and tourism and leisure sectors. These properties are located in Gauteng, Limpopo, Free State, North West, Mpumalanga, and KwaZulu-Natal.

One of the key highlights of Akani Properties is the development of the R950 million Radisson Hotel and International Convention Centre Johannesburg OR Tambo in Kempton Park, which was launched by President Cyril Ramaphosa in October 2020. Akani Properties won a bid to construct and develop a hotel and convention centre in Steve Tshwete Local Municipality (Middleburg), a growing mining town in the Mpumalanga province. Akani is also contracted to manage the MEPF’s property portfolio.

Neighbour Funeral Services

The Neighbour Funeral Group Scheme was established in 2017, initially as an affordable funeral product for the working class and the Christian communities of Southern Africa. Over the years, it has grown into a fully-fledged funeral scheme servicing close to 80 000 members across the length and breadth of South Africa, ensuring that the loved ones of the working class are buried with dignity.

By tapping into the spirit of “neighbourliness–a common practice in African communities dating back to many centuries ago–Neighbour brings comfort to millions of the working class by providing financial security at the time of loss of their loved ones.

With its origins as a funeral scheme of one of the largest pension funds in Southern Africa, Neighbour has spread its wings to the broader working class in Southern Africa.

Neighbour is administered by Akani Retirement Fund Administrators and underwritten by Old Mutual.

Munghana Travel and Tourism

This is an exclusive travel and tourism company which specialises in travel management solutions for discerning business and leisure. The company specialises in bespoke travel and leisure packages to suit individual tastes.

Akani Energy

The company’s main focus is renewable energy and currently provide consultancy services relating to the installation of solar on-roof solar panels as well ground-mounted energy solutions. The company also specialises in the supply of electrical cables such as low, medium, and high voltage power cables, as well overhead conductors.

Two-pot retirement system

Following September's introduction of the two-pot retirement system, like other pension administrators, Akani Pension Fund Administrators is assisting pension members who want to take advantage of the new provision, which allows them to withdraw some funds from the savings component.

In terms of the system, after the 1st of September 2024, all pension contributions are to be split, with one third of the contributions going to a savings pot and two-thirds to the retirement pot. In terms of the system, on the 30th of August 2024, there was a once-off compulsory transfer of the employee’s retirement savings (capped at R30 000) to the savings component. The rest of the money remains in the vested component.

Now withdrawals can be withdrawn from the savings component for emergencies, with the amount drawn subject to nominal tax. If one chooses not to withdraw from their savings pot, the remaining funds will be taxed as a lump sum benefit upon retirement, following the retirement lump sum tax table. These tax rates are generally lower than the marginal tax rates applied to withdrawals before retirement.

Under the system people can only withdraw one-third of their retirement component upon retirement. The remaining balance will be distributed as fixed monthly payments. However, once one retires, if the total amount of their retirement component plus what is left in the savings is less than R165 000, they may withdraw the full amount.

From the government’s point of view, the system is aimed at balancing immediate financial needs with long-term financial security, offering flexibility while safeguarding retirement savings. By allowing partial withdrawals for emergencies while protecting most of the savings for retirement, the system addresses past challenges where people could cash out their full pension savings when changing jobs, leaving nothing for retirement.

While confirming that his company Akani Retirement Fund Administrators is ready to help facilitate a smooth withdrawal process–including running education programmes for the potential withdrawers, Letjane is not in favour of the two-pot system.

He feels it does not promote adequate retirement provision. He also feels that instead of helping the workers carrying the heavy yoke of financial distress, the system is benefitting the South African Revenue Service (SARS).

“The eventual beneficiary in this system is the South African Revenue Service (SARS) because unlike previously where pension contributions were non-taxable, and the pension pay-outs were taxed at a lower rate, in terms of the new system, the withdrawals are regarded as part of income and are therefore taxed in terms of one’s nominal tax rate.

“This creates a situation whereby, for example, the withdrawal can push someone into a higher tax bracket. Essentially this is going to reduce the amount saved for retirement; a rather dire situation in a country where research shows that only six percent of the retirees can retire comfortably.”

The introduction of the two-pot retirement system has been challenged from several quarters including labour, with the argument that given the country’s current situation where the majority of workers live in a state of economic emergency, the system will be of no help to those it seeks to help.

Unfortunately, the 2023 FinMark annual FinScope Consumer South Africa for 2021 does confirm the concern raised by those who do not buy into the two-pot system.

According to the survey, the rising cost of living is significantly impacting South African households’ wallets. Consumers are struggling with an average worker not being able to provide themselves and their family with basic necessities of life and therefore not able to save for their retirement.

It also revealed that, for example, due to financial constraints, two out of every five individuals reported their homes being without electricity in 2023. The survey report essentially puts a spanner in the government’s assertion that the aim of the saving component is to help pension fund members to deal with financial emergencies they find themselves in, because, as the survey shows, the majority of South African workers are already living in an “economic emergency”.

For labour and some civil society organisations, the solution to this “state of economic emergency” is to pay a living wage which is sufficient for a worker to provide themselves and their family with the basic necessities of life and save something for the future or to cover whatever arising emergency expenses.

For Letjane, the solution to the dire situation is to introduce compulsory pension as a benefit to all employees.

This means it must be made compulsory for all employers to contribute to their employees’ retirement. This, Letjane contends, will deal with the widespread income insecurity on retirement for the majority of South African workers. To ensure compliance to the law by the employers, there must be penalties for non-compliance.

Currently it is compulsory for employees to become a member of the pension fund that the employer participates in, but it is not compulsory for the employer to become a participant in the pension fund. Only in some industries, where there are bargaining council agreements, employers are bound to participate in industry retirement funds and to make fund membership a condition of their contracts of employment.

Akani Group in the spotlight

Recently, Akani came into the spotlight following media accusing Letjane of not acting in good faith and gaining improper advantage for his company to the prejudice of the Municipal Employees Pension Fund (MEPF) and acting in conflict of interest; essentially betraying the trust the fund has in Akani Pension Fund Administrators.

These sentiments arise from a 2018 transaction in which MEPF apparently paid Akani Properties R333 million to purchase a small agricultural holding. Akani Properties is Letjane’s property management company contracted by the MEPF to manage its property portfolio. The contention is that the piece of land was overpriced.

In response, Letjane says the property in question was not just a piece of land, but a fully developed property that included The Destiny Hotel, OR Tambo International Convention Centre, and several other structures. Letjane also dismisses any claims of improper financial dealings on his part and also calls out the description by the media of the sold property as a piece of land, describing the whole saga as an attempt to erroneously underestimate the size of property involved.

His assertion is that in the 1990s he acquired several properties, later consolidated into a single ERF (ERF 155). These properties formed part of Akani Properties and were developed into what became the Destiny Hotel–a fully operational hotel that served visitors during major events such as the 2010 FIFA World Cup, as well as a Wellness Centre and the OR Tambo International Convention Centre. After the sale, the property underwent significant changes, including a rebranding, and is now known as the Radisson Hotel and International Convention Centre Johannesburg OR Tambo.

On the R333 million paid by MEPF for the “piece of land”, Letjane points out that the property was professionally evaluated by Akani Properties, MEPF, and independent valuators, who collectively determined its value to be R555 million (excluding VAT). Adding that MEPF also conducted its own due diligence, which included a feasibility study.

Letjane also ascribes the allegations against his company to the fact that he is an outstanding entrepreneur in a sectors where very few black business people have thrived.

“When we (Akani Retirement Fund Administrators) took over as the Municipal Employees Pension Fund administrator in 2003 it was worth R1.4 billion and its value today is over R26 billion. What is happening now with all the allegations against Akani is because I am scaring my competitors who think I neither deserve nor have the capability to run such a successful venture in a sector regarded as the exclusive playground for others unlike me.”

Providing some clarity on the two of his companies that have dominated headlines recently, Letjane says Akani Properties and Akani Pension Fund Administrators are two commercially separate entities with the former having the responsibility of not only managing the MEPF property portfolio, but also contributing to its growth. According to Letjane, the MEPF has appointed Akani Properties in recognition of his experience in the property sector.

“It is because of my experience in the property sector that the MEPF appointed my company Akani Properties to manage its property portfolio,” says Letjane.

Ido Lekota is a former Sowetan Editor and regular contributor to BBQ Magazine.